PACE Financing + Green Roofs – It’s the next BIG thing!

Advertisement

Many U.S. municipalities and counties have incentives to use energy efficient equipment and green stormwater infrastructure practices on projects. For commercial building owners, who spend $200 billion per year on utilities, with 30 percent of those dollars essentially wasted through energy inefficiencies, these green building incentives should be considered by every building owner, developer, and design team.

Commongrounds Building – Traverse City, MI. Photo: Inhabitect, LLC

Constructing more efficient buildings is even more attractive and feasible when PACE (Property Assessed Clean Energy) Financing is utilized. This funding mechanism gives commercial and multi-family property owners, non-profits, and other entities the opportunity to finance the installation of energy and water efficient technologies, including green roofs, living walls and other green stormwater infrastructure, such as permeable paving and rain gardens, at ground level.

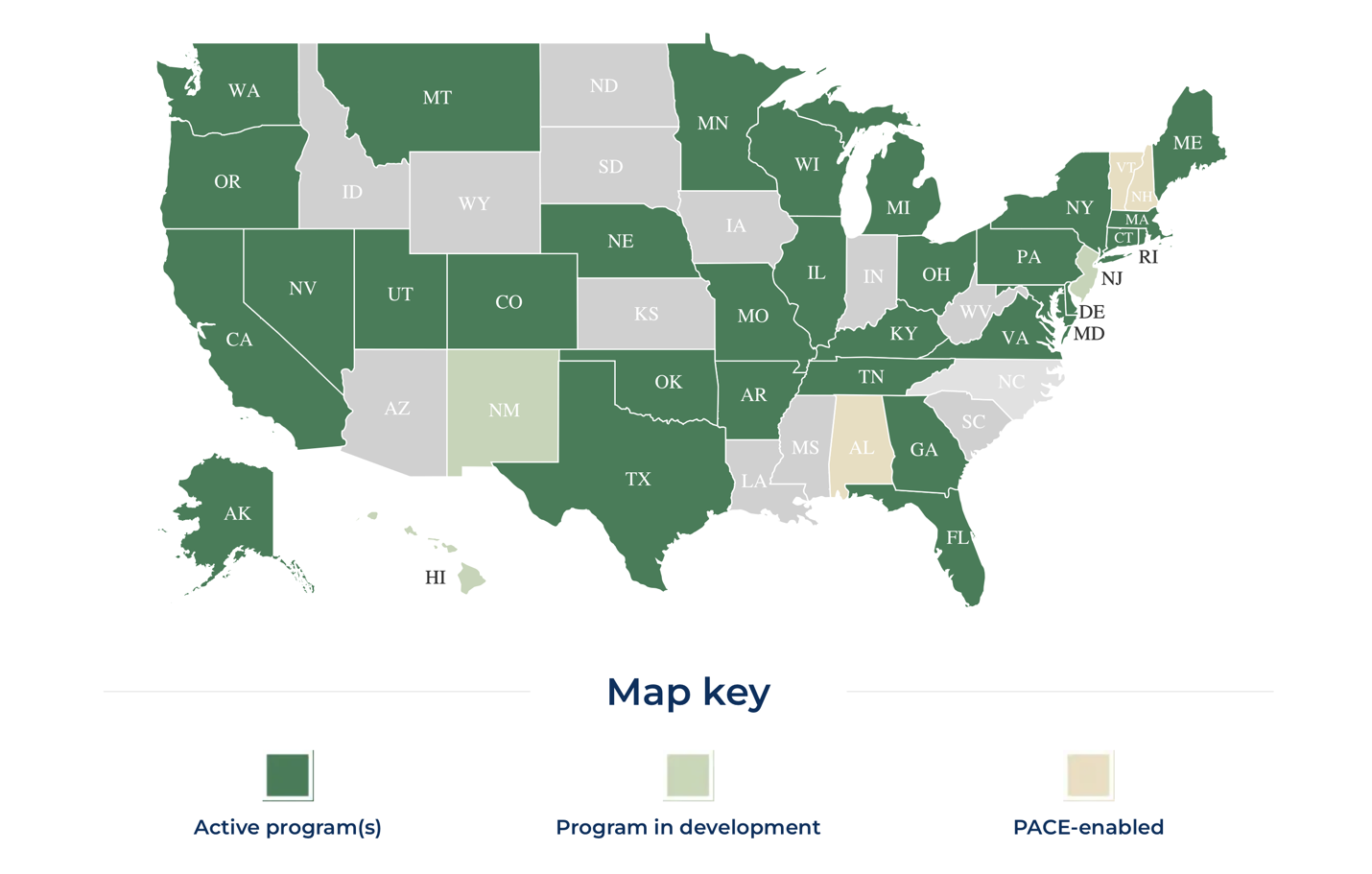

Implementing this funding requires your project to be in a PACE-enabled state. Some states, including Michigan, require individual county governments to create a PACE district before a project qualifies for funding. There are currently 38 states, plus Washington D.C., that have active PACE programs and others are actively developing their programs.

The image above shows all the areas that PACE supports. Photo: pacenation.org

Once you have confirmed you are in a PACE district, it is time to align yourself with an approved PACE contractor and/or consultant. This organization should be able to confirm which technologies, methods and equipment will qualify for funding under PACE. From there they can help determine if this financing is a good fit for your project. There are many PACE contractors throughout the United States but not many that have successfully included green roofs and other green stormwater infrastructure into their offerings.

Advertisement

Do I qualify for PACE financing?

PACE loans are available for the building of new or the retrofitting of existing privately-owned commercial properties as well as non-profit entities:

Hospitality businesses & hotels

Retail stores & restaurants

Non-profit cooperatives

Private schools

Churches & other places of worship

Office buildings

Mixed use developments

Industrial complexes

Multi-family housing

Hospitals & healthcare facilities

What does PACE financing cover?

Solutions that can be covered under a PACE loan are broad. In general, if a proposed solution can provide noted energy, stormwater, and utility savings, it can usually be included in a PACE project. Some examples include:

Energy efficiency: lighting, HVAC systems, windows, etc.

Water efficiency: low flush toilets, low flow fixtures, gray water solutions, etc.

Renewable energy solutions: solar, Combined Heat & Power (CHP), etc.

Green Stormwater Infrastructure: green roofs, blue roofs, rain gardens, permeable paving, etc.

Green roof specific funding?

The PACE process is different from traditional funding and construction methods, so it is important to use an experienced company. This is especially true if you plan to pursue green roof and green stormwater infrastructure funding. Inhabitect, LLC managed Michigan’s first PACE-funded retrofit green roof project — the Belt Line Center in Detroit, MI. Not only was it the first of its kind in the state and Wayne County, but it’s currently the first green stormwater infrastructure project that was solely funded by PACE in the United States. It includes a 17,500-sf green roof, 2,000 sf blue roof, permeable paving, and a larger rain garden.

Belt Line Center, Detroit, MI. Photo: Inhabitect, LLC

Belt Line Center is an example where a green roof was the driver of closing the funding, without it the PACE deal would not have worked. PACE was also the only financing solution that worked for the owner because they required a zero money down deal. The green roof and blue roof protect the waterproofing membrane and Inhabitect formulated a proprietary calculation that computes the long- and short-term financial benefits of these coverings. The calculation shows that a green roof pays for itself, through public and private benefits, and it was able to provide a funding solution that was cost-effective and low-cost. A similar solution might be perfect for projects across the entire country!

Over 200,000 lbs. of roofing, concrete topping slab, broken brick and sand was removed from this rooftop, all funded by PACE. This roof deck was a perfect candidate for a green and blue roof which both drastically reduce the site's stormwater runoff volume.

Advertisement

New and Retrofit Options

PACE financing is perfect for new developments as well. The Commongrounds project in Traverse City, MI used PACE to fund numerous pieces of its project, including green roofs, pedestal pavers and even solar. This was a new development and the owners received $1.85 million in funding with the help of Inhabitect, LLC. The funding process on a new development is more streamlined when compared to retrofit projects, but the process still requires experience in green stormwater infrastructure technologies.

PACE funding is not only related to energy, but it must also consider the useful life of the building and the systems being installed. A qualified PACE contractor will consider the costs associated with not only energy consumption and savings, but also with managing stormwater, as well as the carbon footprint associated with the structure during its entire lifecycle – something that is extended when green roofs are utilized.

Green roofs or pedestal pavers, as they pertain to PACE, are technically roof ballast that extend the longevity of your roof membrane. There are proprietary and readily available methods related to calculating the value of this extended longevity, so it is advised that you seek out a qualified company that has ties to the technical aspects of the roofing/waterproofing, green roofing, landscaping and the PACE marketplace if you want to fund these features within your next project.

Where does the money come from?

PACE loans are funded by private capital and repaid through a special assessment on your building’s property taxes. By eliminating the need for upfront capital and spreading costs over a period of time longer than most commercial loans (up to a 25 year term), a PACE-funded project brings owners the opportunity for immediate positive cash flow.

When the efficiencies are realized and the energy, operations, and maintenance savings generated from the technologies utilized are greater than the annual PACE loan repayment, you have truly “gone green” while also building yourself a more solid financial future, freeing up resources to use elsewhere or on other projects.

Ensuring Green Roof Success

Rolling green roofs and other forms of green stormwater infrastructure into the financial stack of a project helps to ensure these critical technologies are not value engineered off your next project. It is my belief that PACE financing is a tool that can help the green roof and green stormwater infrastructure industries further solidify themselves into the construction industry. Gone are the days of a green roof being specified solely for its aesthetics, these rooftops can now be used to leverage the feasibility of the development itself while also blending with more standard and common energy and water efficient solutions.

Advertisement

Nathan Griswold, founder and president of Inhabitect, LLC, has worked in the landscape industry for 24+ years. He has played critical roles in the design, development, sale, construction, and successful establishment of nearly 1,000 green roofs across North America in this time.

Click here for more information about PACE financing.